Art has evolved from the caveman-style art created by primitive man, through to the digital light shows and virtual reality of today, but where is it headed as an ‘industry’?

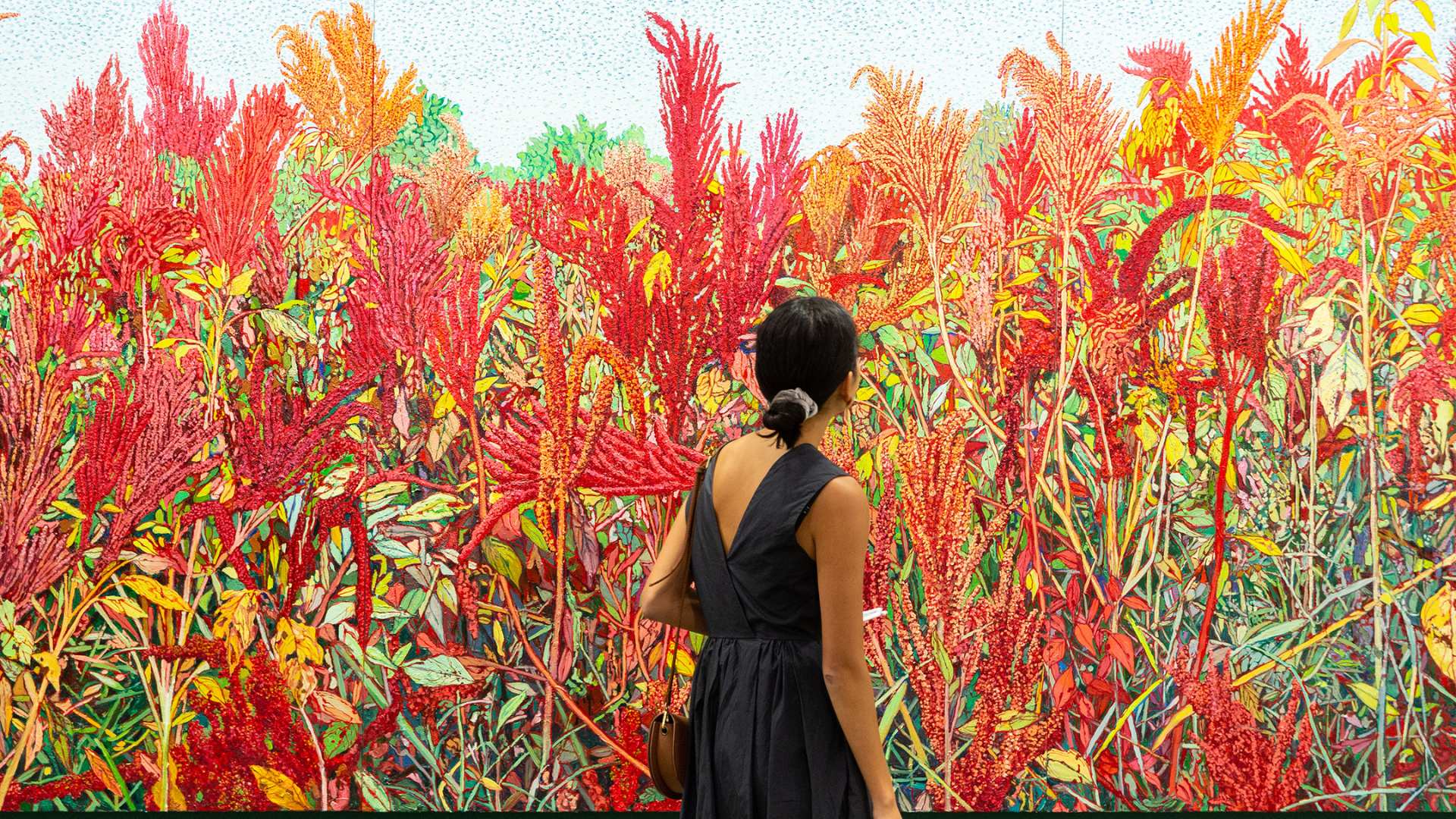

Like anything and everything in today’s world, technology is playing a large part in how the art world will evolve over time. “We’re already seeing that artists today are moving beyond the four walls of established institutions (such as museums) and are directly engaging and inspiring a range of new audiences”, says Richard Koshalek, director of the Smithsonian’s Hirshhorn Museum.

What does this mean for the industry as a whole? The humble canvas and paintbrush are to be replaced by a keyboard and screen?

Like every industry in the world today, art has evolved, iterated and matured as technology has become more prevalent to new generations of lovers, followers and sceptics of art around the world. But make no mistake; the masterpieces are still that, with the sale in December 2017 of a Da Vinci for over $450 million– there is still a demand.

While not ever young artist can boast a sale of that magnitude, never has there been a time for innovation, iteration and inspiration as now, which should see some significant results coming through.

Global art grows for the first time in a long time

In 2017; the global art market grew by about 12% with around $63.7 billion in sales. The majority of growth was driven not through the traditional ‘art galleries’ – which still boast the largest percentage of the market – but from the art events and fairs that are held around the globe.

This market grew by 17% in the period, showing the shift from the traditional gallery sale, through to the new age of ‘event-driven sales’. Not only do these events, galas, golf days or cruises provide an opportunity to purchase art, but also for art collectors, investors, enthusiasts – and just about anyone – a profound networking opportunity for whatever their chosen field may be.

With the market moving away from its traditional home of Europe, sales in Asia accounted for 23% of all art transactions in 2017.

What opportunities do these changes present for art lovers?

With Asia being such a prevalent place for art to be bought and sold, there is a significant demand not only for the purchase of the artwork, but the lease.

As an investor, receiving a guaranteed 6%return on your purchase from private or corporate leases is a significant return on an investment that will also see principal value growth over the same period!

Art allows investors to protect their portfolio from volatility and with the high demand in Asia and especially China, their liquidity is very high in today’s current climate.

To learn more about investing in art as an asset class, not just a ‘pretty picture’, speak with the team at Art Works Singapore today.