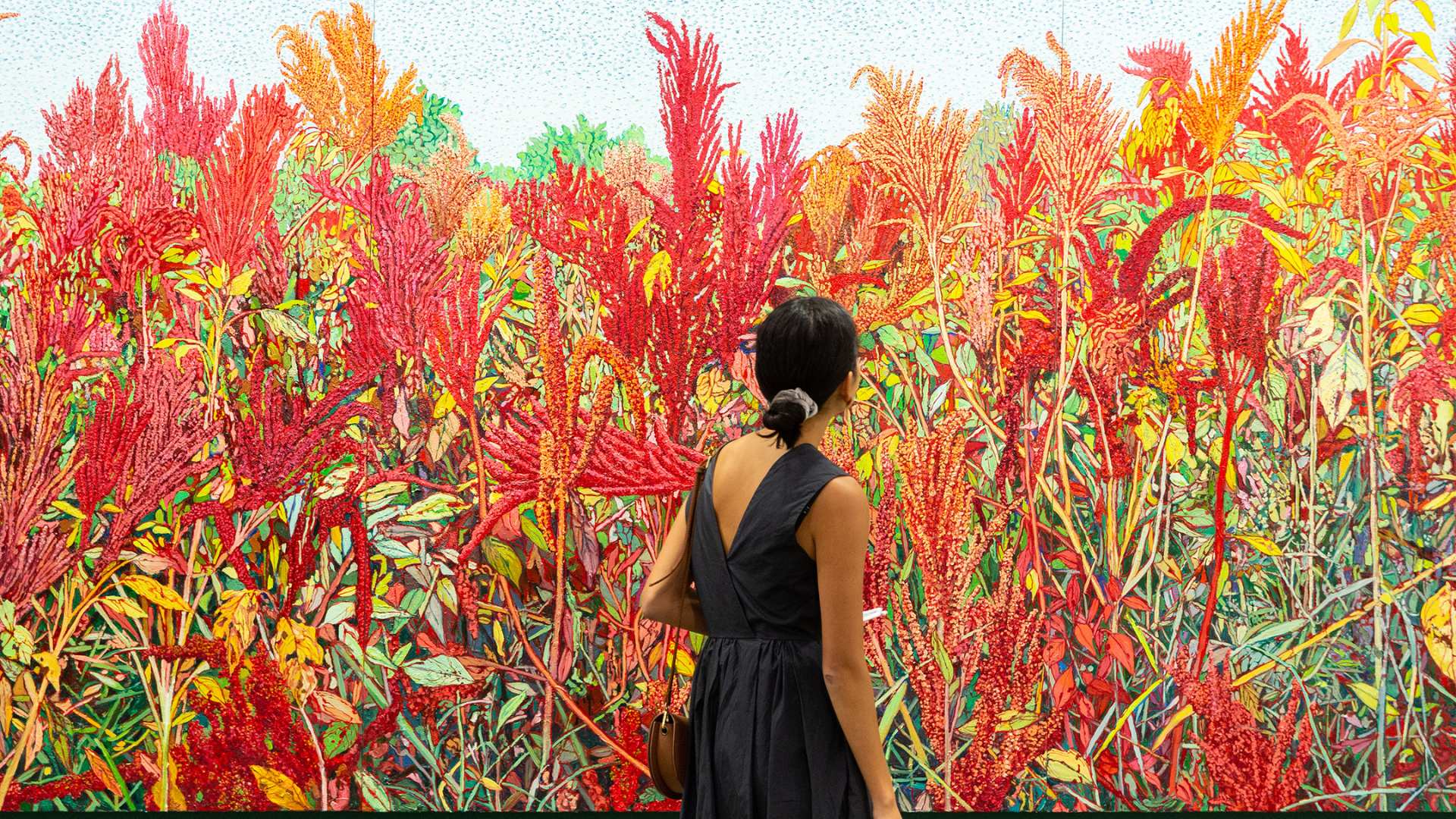

As an art collector, have you considered acquiring limited-edition prints to your portfolio? Here’s what you need to know when purchasing this exquisite form of art.

Unlike mass-produced artworks, a limited-edition print has preserved value over time as supply is eventually discontinued. Collectors and art lovers are able to enjoy this restricted number of prints available until the edition runs out. Moreover, this also means showing support to artists and printmakers who are skilled in their field.

Being an art investor, limited-edition prints are worth considering as an additional opportunity to your growing portfolio. If you have missed out on acquiring an original painting, there is a chance you may gain access to an artist’s works with his/her limited distribution pieces, potentially set to appreciate in value.

Fine art provides profitable opportunities for investors. Limited-edition prints can provide access to the world of art investment to those with less discretionary funds available to invest. From a few thousand dollars onwards, one is able to embark on his/her investment journey by starting with limited-edition prints.

Take some of the prints of everyone’s favourite children’s storybook, Dr. Seuss. Classic images from his stories have been put into limited-edition print runs. Some prints started being available from USD $1,000; larger prints from around $2,500. These limited-edition prints are now valued at over $35,000 less than a decade on. Not a bad investment in anyone’s books!

Knowing how to distinguish and assess the value in limited-edition prints is highly important when making an educated decision on appreciation of its value. As with other forms of fine art, investing in limited-edition prints also requires an acute understanding of the art market, supply & demand and selected artists who are up-and-coming.

Investing in art is not just about owning a masterpiece or a print, but about looking for works that will appreciate in value in the short, medium and long-term. Having expert advice on hand when investing in any art is always the first step to sound art investment. Limited-edition prints are no exception.

Art Works is Singapore’s leading art investment advisory, providing a wide array of consulting, leasing and sale-for-lease arrangements. This allows their clients to realise immediate monthly ROI on their works through leasing to corporates and private homes.

While a limited-edition print may not have the same grandeur and value, one should rule it out as a solid investment. Evidently, a Pablo Picasso print sold at auction for $5 million and can be said to have further established a market for collecting limited-edition prints.

So, what to look out for in a print?

Some limited editions may be created posthumously, and their value should not be discounted.

A factor to consider in the world of limited-edition art is the number of prints in a run. When the edition is smaller, less numbers are created and their value is increased.

Methodology of printing affects the value to limited edition prints. With advanced technology in printing today, many artists opt for digital printing for accuracy. However, at the turn of last century, limited-edition works were created using an extremely time consuming and laborious process – thus increasing their value.

As an indication of completed work ready to be collected, look out for the artist’s signature which can also be taken as a proof of authenticity.

Limited-edition prints offer art lovers and investors a unique opportunity to step into a world of art investment. The ability for investors to own a work that has passed through the hands of the greatest artists of our time is something extremely special to many lovers of art.

As an investment, limited-edition prints can be a profitable opportunity with guided informed advice so should you be looking for portfolio diversification, speak to Art Works today.