The value and return of fine art in recent years have seen a dramatic rise of markets – such as China – as the increasing need for portfolio diversification take hold.

With the Salvator Mundi’s sale in November 2017 at Christie’s for $450.3 million, purchased in 2013 for $127.5 million, there are few that can doubt the value and returns of fine art.

The value of art was traditionally measured in the increase in the value it may – or may not – have had over the time the owner held the work. Only in recent times has art been seen as an ‘asset class’ or investment vehicle to capitalise.

Thanks to innovative ‘leasing agreements’, investors can see past the rise in the asset price, but also enjoy annual returns of up to 6% year on their fine art, as corporates, governments and even homes around Asia require art on a lease arrangement, rather than purchasing it themselves.

This new way of thinking allows the value and returns of fine art to offer an annual dividend as well as the asset value growth, making it one of the most attractive asset classes to diversify investment portfolios within today’s unstable markets.

How has the global fine art market performed?

Fine art auction turnover reached $14.9 billion for the full year 2017, while the global art market was worth a staggering $63.7 billion up 12% year on year in 2017.

Online sales saw a large increase of 8%, proving this avenue is a new way to reach client bases all around the world. With such a traditional industry embracing and reaping the rewards from technology, the demand – especially from China, USA and the UK – has increased dramatically putting upward pressure on prices, value and returns for investors in the category.

Where is the value in fine art found?

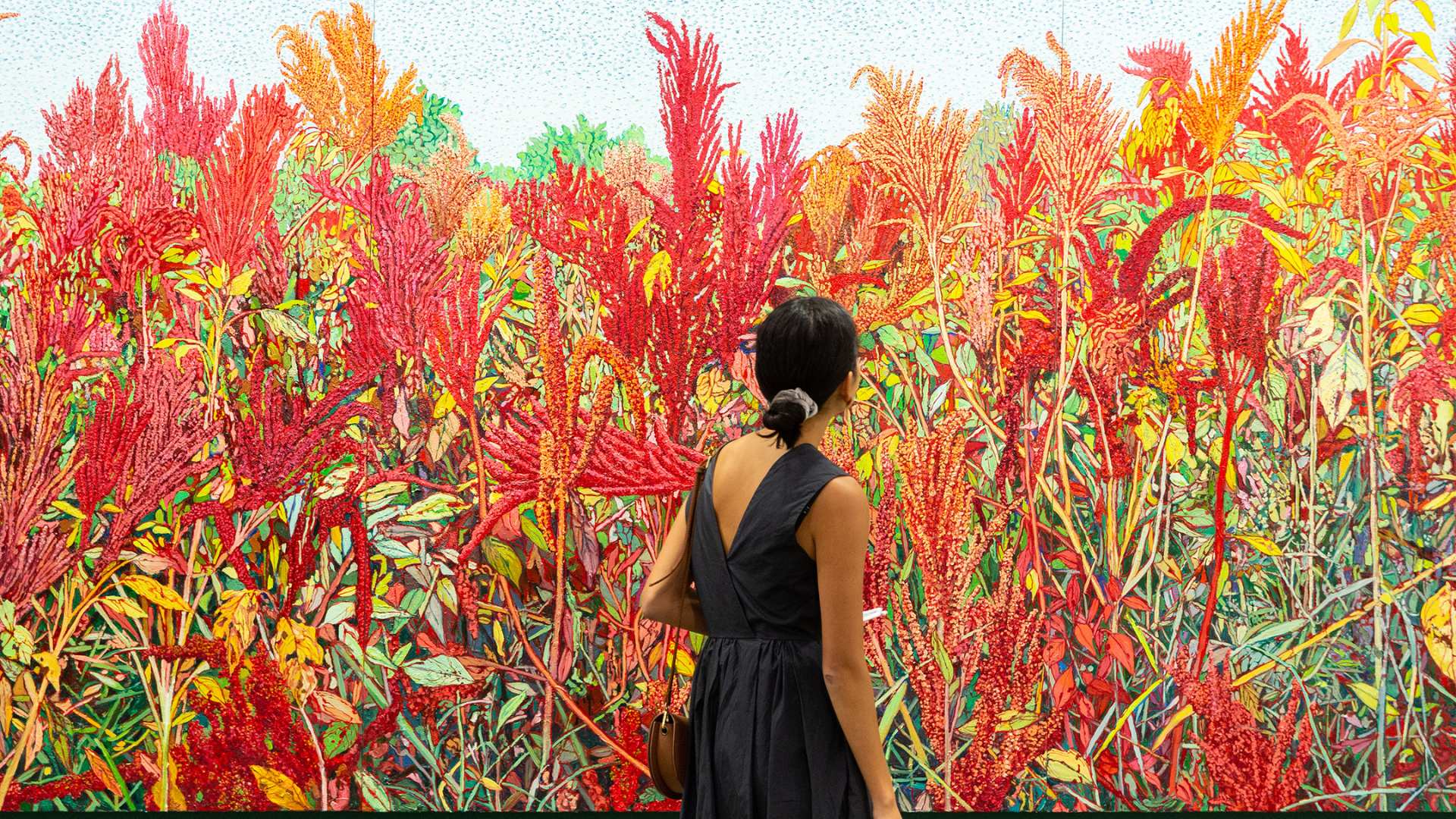

Although not everyone can purchase a rare painting for $430.3 million, the key to investment in fine art is to find artists on the rise in popularity that may be small, but are set for big things.

These pieces can fetch significant returns as the artist and their works become more readily spoken about – but early adopter or investors to their works can capitalise upon this growth and gain strong ROI in the long term.

How can you realise the value and returns of fine art?

To put it simply, when you are looking to invest in shares, speaking with experts & brokers or financial advisors is traditionally your first step. This is no different in the world of fine art investment.

To ensure you maximise fine art as an investment opportunity, speaking with experts who know & understand the market is the first step to success. Companies such as ‘Art Works’ in Singapore, specialising in art as an investment, not simply a thing of beauty.

Removing the emotion from the purchase and looking at qualitative and quantitative information to inform their clients, Art Works can prove that the value & returns on fine art can surpass many other asset classes simply through implementing their refined process through their expert team of art experts & investment consultants.

Speak to the Art Works team today to realise the potential of art as your next investment.