Artfully on the rise

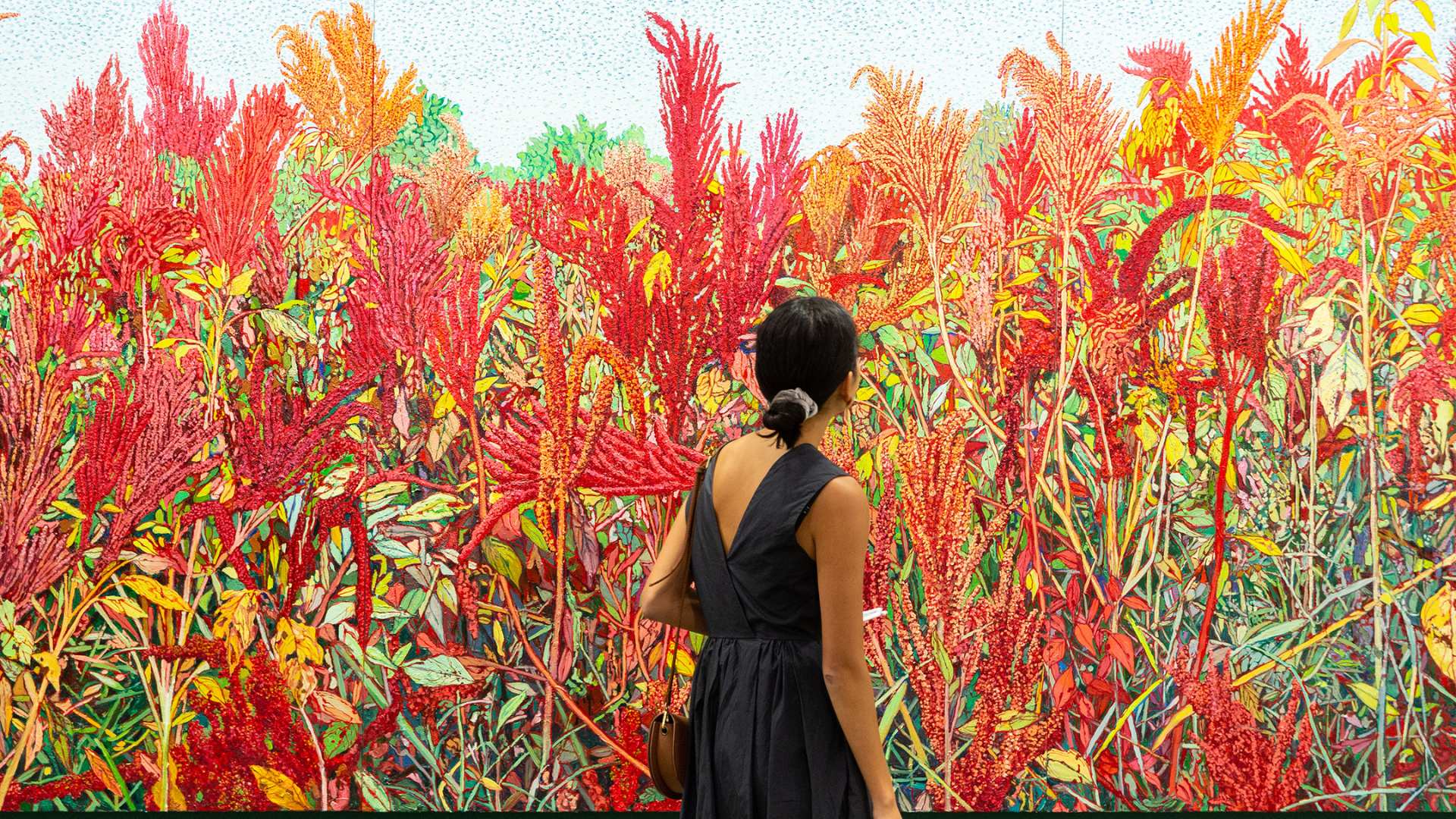

The art market is a powerful beast and, thanks to a surge in art investment, one that promises to increase in the future.

In 2016, the global art market achieved a total of US $56.6 billion. Although this was down 5% in volume on the prior year, there were still over 36.1 million paintings sold, demonstrating the sheer size and scale of the global market for art.

With the largest markets dominating 81% of the total market – that being the US, China and UK – in 2016 China re-emerged as the clear leader of the global art market with an auction turnover total of $4.79 billion from 91,400 lots sold.

As an investment asset class, fine art is something that has not only proven to provide significant asset value increases, high liquidity and annual income potential, but it’s something that can be enjoyed by all those who get to view and experience it for themselves.

Art is an asset class that is in demand

Other asset classes can be adversely affected simply by the US President sharing a tweet – take the example of Amazon sliding as much as 10% in a day, pending trade wars between the world’s two largest economies and Brexit leading to the potential breakaway of the UK from free trade arrangement. It’s fair to say, with the majority of investments other than art – nothing is safe.

Art is an asset class that has been steadily increasing for literally thousands of years. From the $450 million Di Vinci that sold recently at auction through to simple ‘limited prints’ ballooning in value over 25% as soon as they are sold out, art is a market that offers investors significant returns.

With the rise of multinational companies opening offices all around Asia as their markets become more open, fine art is in high demand not only to purchase but to lease, offering investors annual returns of 6% in rent, as well as the value growth of the asset itself – a significant opportunity.

Buyer beware, not all art is the same

It is paramount if you are looking to invest in art proper advice is sought, allowing for the guesswork to be taken out of the process and ensuring that your risk is hedged to ensure the longevity of your returns in this powerful investment vehicle.

Speaking with art investment experts that look to not only find you a piece that you love but a piece that will grow in value and be attractive to future buyers but also attracts significant retail returns is vital. Removing the subjectivity from the process and engaging a methodical, objective and quantifiable approach to your artwork purchase will allow you to effectively harness the power of the art market and start returning on your capital immediately.

Invest in established and experienced art investment specialists

For more information on how art can be used to diversify your portfolio, hedge from the risk of other volatile asset classes, while establishing residual and substantial annual returns, speak with Art Works Singapore today.

Art Works has offices in Singapore, Hong Kong and Sydney and aims to bring together the buyers of art, those who wish to lease the works – such as corporates, residents, hotels, restaurants and other businesses looking to make an impression – and find the pieces that will exceed the requirements of every stakeholder in the process.

Call their team of experts today for an obligation free consultation and review of how art investing can drive your investment dollar further.