What Does This Mean for Art Investors?

With many global equity markets bouncing all over the place with the rising cost of doing business, once unbreakable businesses are succumbing to ‘disruptors’ and consumer sentiment changes, coupled with growing geopolitical security and asset overvaluation in many parts of the world, investing is not what is used to be.

With this in mind, many investors are looking to ‘other’ asset classes to diversify their portfolios with and realise returns on capital investments in the short, medium and long-term. One of these investment avenues that has seen a significant increase is that of fine art, with a “growth of 12% and sales totalling just under US$64 billion” in the past year.

This growth was not only due to diversification in portfolios, but the seismic rise in the Asian demand for fine art, particularly as the Chinese middle-class wealth rises significantly. China’s middle class is forecast by McKinsey & Company to reach 550 million by 2022 and comprise 75 per cent of urban households.

Economist Dr Clare McAndrew explained that “compared to 2016, the Chinese market has grown by 14%. The art fair concept is still catching on in Asia. In the 1990s, the market took about 15 years to recover, whereas, following the 2009 crash, it bounced back almost straight away due to a boom in Chinese sales. Now there is a more diversified base, which protects the market as a whole. In terms of high net-worth individuals now, the Asian region is bigger than North America.”

So, what does this mean for you?

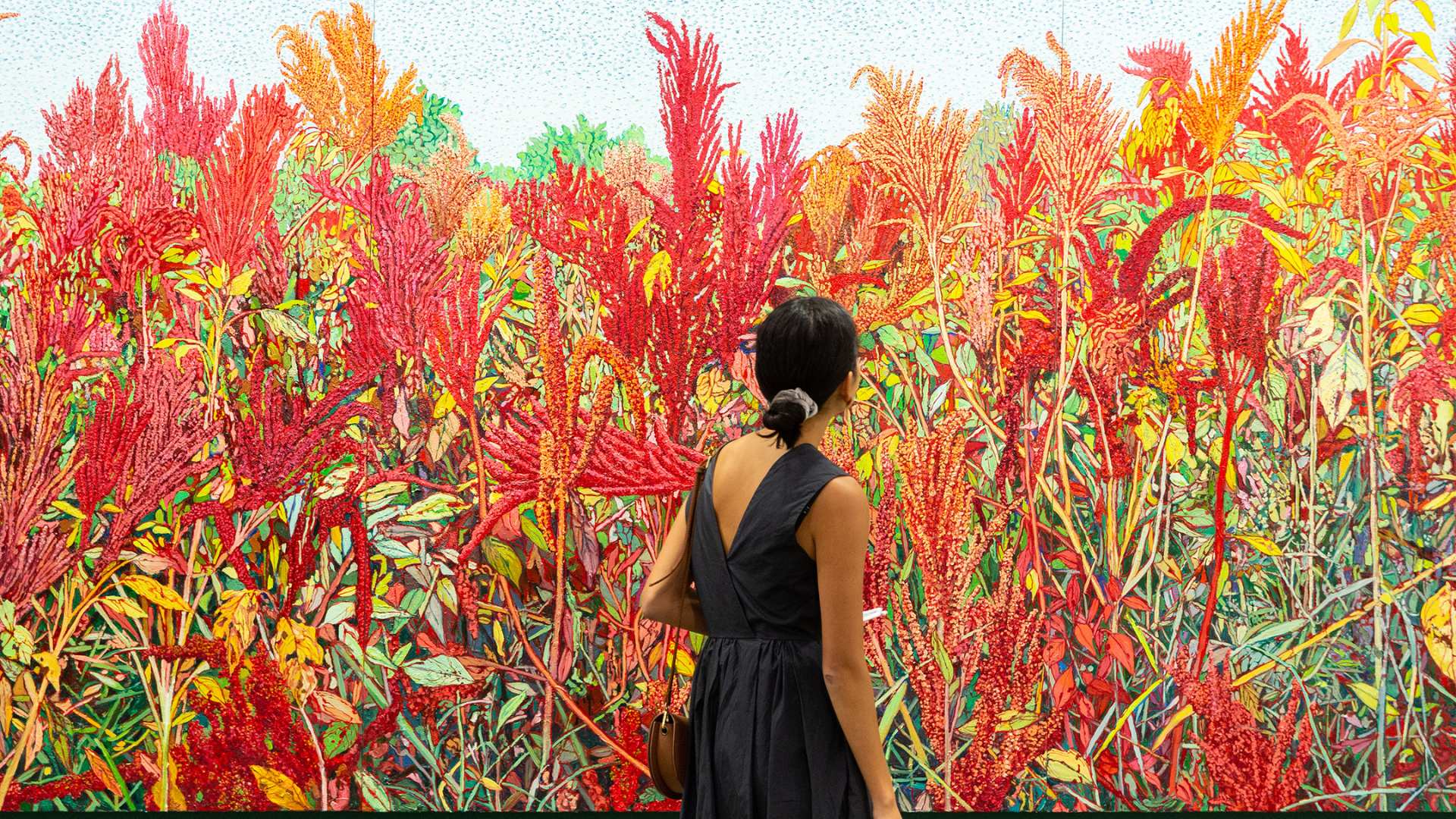

As an investor, there has never been a better time to review the opportunity of fine art. With an extremely positive growth in the capital asset value, not to mention the potential for annual, recurring revenue through the leasing of art to business and private users, there are few assets that have offered such significant returns.

Not all art is created equal, not to mention the forgeries, fakes and scams that may affect your investment. It is always paramount, that like you would source professional assistance and services for capital, securities or just about any investment, you should do the same with an investment in art.

Speaking with experts in art investment will allow you to take advantage of the rebound in the global art market through purchasing ‘in-demand’ and ‘on the rise ‘artists’ that although may not be a household name such as Van Gough, however, they offer significant opportunities for your investment portfolio.

Art Works Singapore specialises in Asia-Pacific artworks from around the world that are specifically selected not only to look fantastic on the wall but to appreciate in value and realise up to 6% in annual incremental returns year after year.

If you’re interested in art leasing and expanding your investment portfolio into fine art speak to the Art Works Singapore team today to take advantage of their industry knowledge and ensure that you are capitalising on the rebound of the global art market.