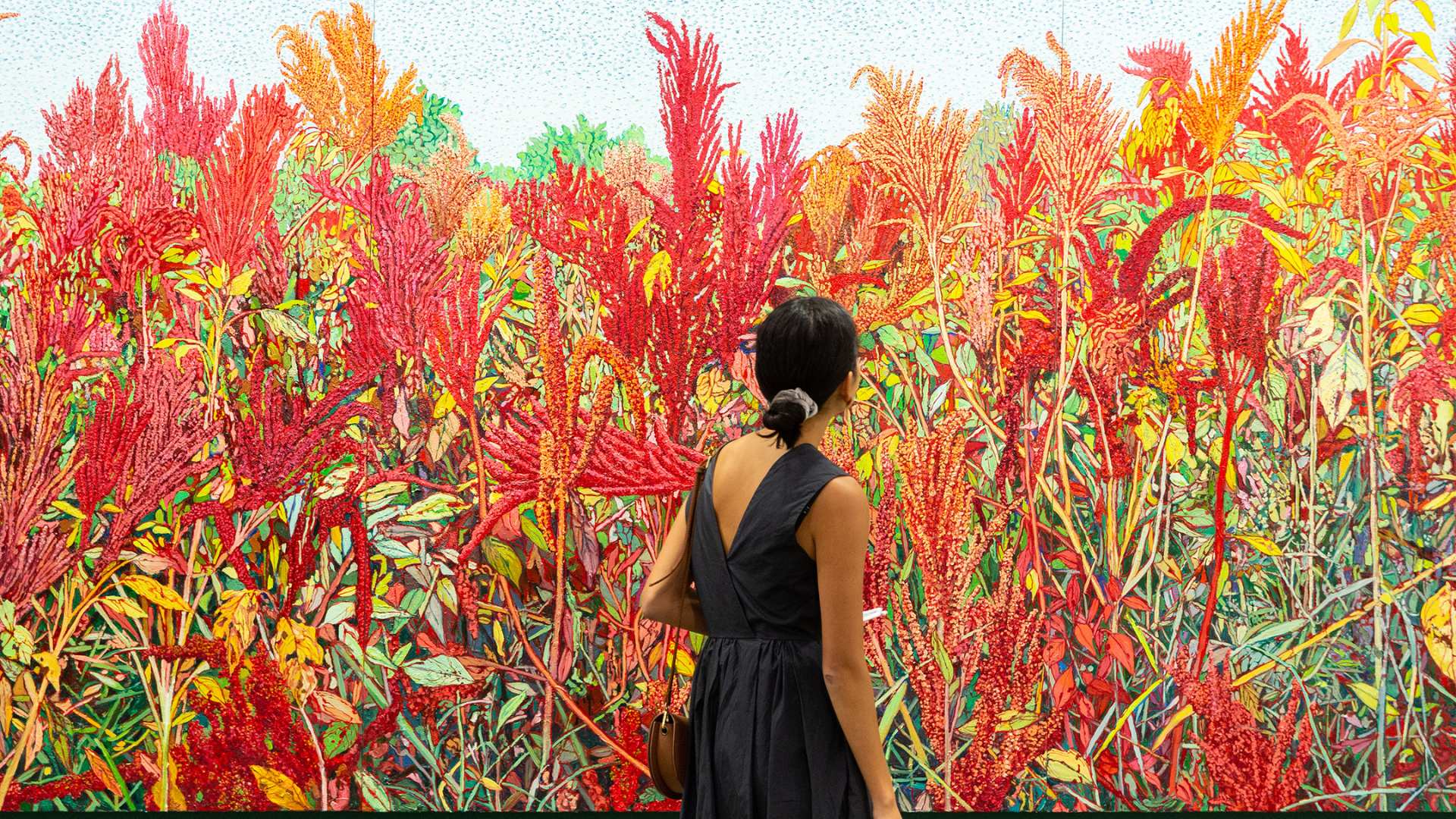

For over 40,000 years art has been used to communicate and to capture moments in time. Art first appeared on rocks in caves then advanced to canvas whereby capturing some of the most recognisable works for centuries.

This evolution has never been more prevalent than back in the early 1970’s when Geoffry Bardon, who was instrumental in the early 1970s in Australia, having travelled to the outback town of Papunya, worked with the elders of several communities, encouraging them to embrace their history, their stories and their culture and to capture their unique painting style and storytelling on canvas for the locals, and westerners to learn and enjoy. To this day, it is created, bought, sold and enjoyed around the world.

In this case, like so many art paints a story of time and of events that shaped the evolution of the world to this very day, but what does the future of art hold? Not only in terms of the materials and styles used but also of the market for art as a whole?

The future is bright

As the Asian economy grows, so too does the vast number of middle- and upper-class individuals looking to invest in art for their homes to diversify their portfolios.

According to Forbes Magazine, Asia has more billionaires than any other region (637), showcasing the opportunities that have been captured through the region thanks to the enhancement of technology and trade.

With such a rise in wealth in Asia, the demand for art in the future will grow exponentially due to the downward pressure on demand. This demand growth is expected not only for art classified as ‘masterpieces’ from history’s most famous artists but also for the up and coming artists from around the region and the globe.

When it comes to the hidden art gems and art investment opportunities, art investors are working closely with brokers and art investment experts to find works that are set to appreciate in value – as a savvy investor would do for an investment of any asset class.

Selecting from works from all around Asia and the world can be difficult, however, with the right guidance, art investment portfolios can become significantly increase in value in the short, medium and long-term.

Blockchain technology will change the future of art investment

Routinely referenced in terms of its potential future effect on the art world, Blockchain technology aims to open new opportunities for individuals investing in art.

Similar to Bitcoin or Cryptocurrency, utilising blockchain technology for art investment is an easily transferred process. In simple terms, Blockchain technology is classified as individual ‘blocks’ that contain a cryptographic hash of the previous block, a timestamp, and transaction data, essentially payment method that, by design, is resistant to modification of the data.

With this in place, investors have the ability – similar to cryptocurrency – to own a whole artwork or a part of it. Their share is dependent on how many certificates or units of the work they purchase.

Allowing investors to buy art using blockchain technology will revolutionise the market and change the future of art, as well as opening up the type of investors and how they purchase. Essentially, the investor may never see the works or be on the same continent as the piece, and yet, they still have the ability to own and profit from the works.

Blockchain technology is being used by companies such as market research firm Ascribe, to provide an online catalogue of art. This allows owners to assign the rights to third parties, essentially ensuring the records to works are protected at all times.

Just as Geoffry Bardon in the 1970s in outback Australia did, the pioneers in the art and tech space are growing and expanding the markets and the appreciation of art is growing at a staggering rate. In the future, there is a great opportunity within the art market, as unique investment and ownership opportunities present themselves compared with conventional art purchasing of the past.

Speaking with an investment expert about future investment opportunities within the art space is vital to secure the opportunities within this growing and highly profitable marketplace.