Many great artworks over the centuries have been lost, never to be seen again. Historically the plundering of galleries, homes and castles during times of war, devastating losses by fire or damage / loss of masterpieces in transport accidents, are some of the many cases of lost art that has captivated art lovers around the world.

Sadly, these works are lost forever, highlighting the importance to modern investors of comprehensive insurance cover. However, there are many masterpieces that have simply disappeared into collections around the world far from the eyes of the art-loving public, into private homes or offices or even into secure vaults to preserve the value of the investment.

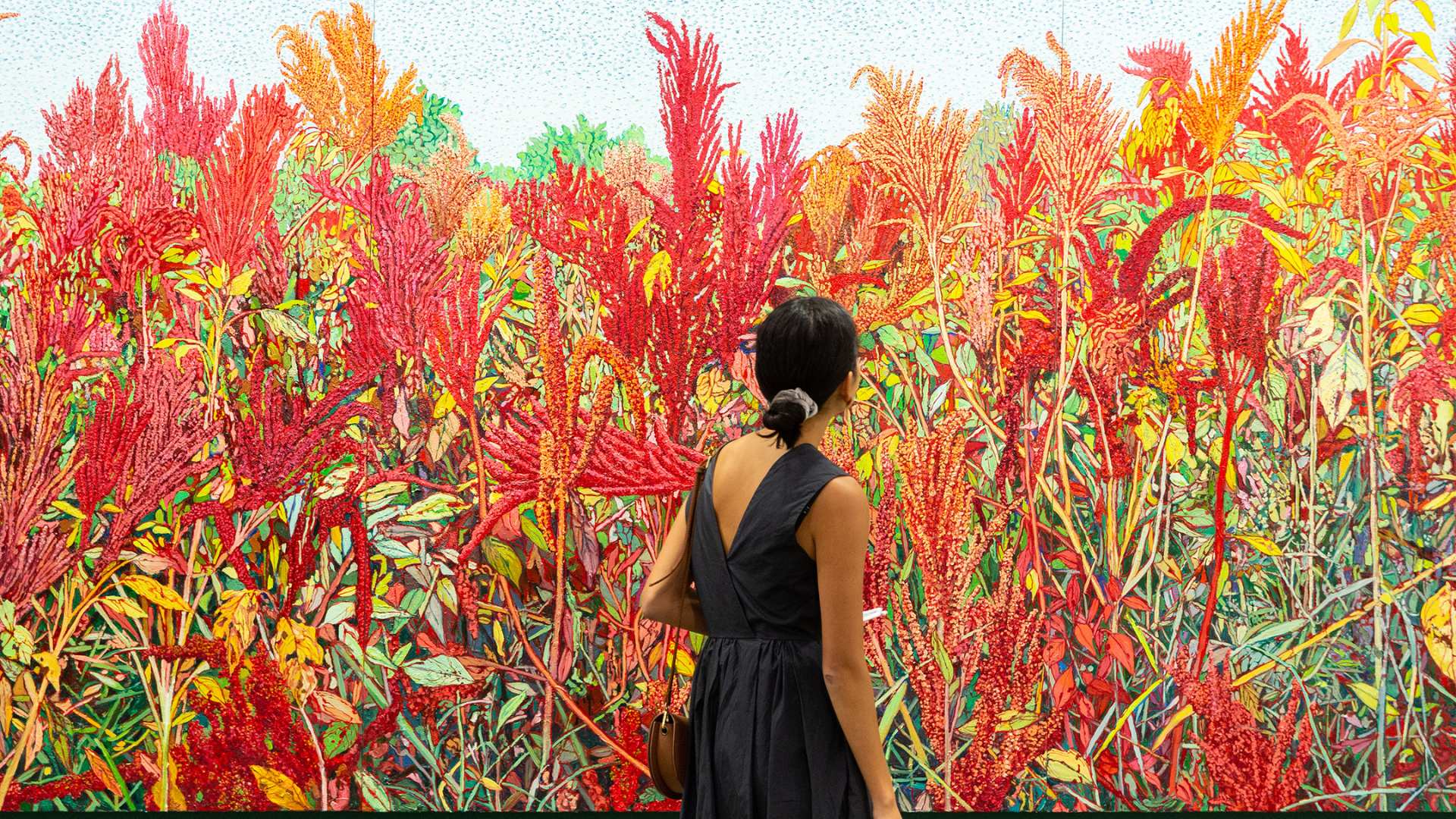

As fine art becomes an increasingly popular investment vehicle and other markets become progressively turbulent, there is undoubtedly a risk of more artwork being placed into private collections or storage rather than being on display for people to enjoy.

Selectively chosen art pieces have long been proving a strong diversification instrument with investors seeing year on year growth of their fine art, while at the same time also realising the potential of corporate and private rentals of their works. Innovative buy-to-lease arrangements can expect up to 6% per annum ROI, making art as an investment a tremendously popular option for the shrewd modern investor.

Leasing of art is thankfully seeing artwork being dusted off and once again enjoyed out of the archives. Investors are providing their pieces to corporations and art lovers who pay a premium to adorn the walls of offices and homes with beautiful art while patiently holding for asset appreciation and leasing ROI concurrently.

Why is so much Art lost?

With many masterpieces worth $1 million or $150 million often being whisked away from the auction house under the veil of secrecy to their new owner’s vault, there is one positive, that at least the artwork will be safe.

There is a critical issue for an industry that is dealing with valuable assets, including important pieces of historical significance, there is usually a lack of a formal register of ownership, allowing important works to essentially evaporate or get lost in the transactions of time.

Works of art, regardless of whether they are being purchased as an investment or passion, have the potential to run into a nefarious situation, or simply be lost or forgotten in a storage vault or backroom without proper notification and documentation being kept.

What can be done about lost art?

When looking to keep track of investment in art portfolios, like all asset classes, collectors or investors alike should keep their own personal asset register. By keeping their accountants or personal advisers up to date with essential information regarding their artworks is imperative in the event of anything happening, the artworks will not be lost.

The safest option within the art industry is to utilise the services of art brokers, portfolio managers and investment galleries who will keep a register of works, their movements, prices and insurance premiums. Managing safe transportation, professional storage, corporate leasing contracts and eventually resale of the appreciated asset.

The future of art investment has never been more lucrative or secure.