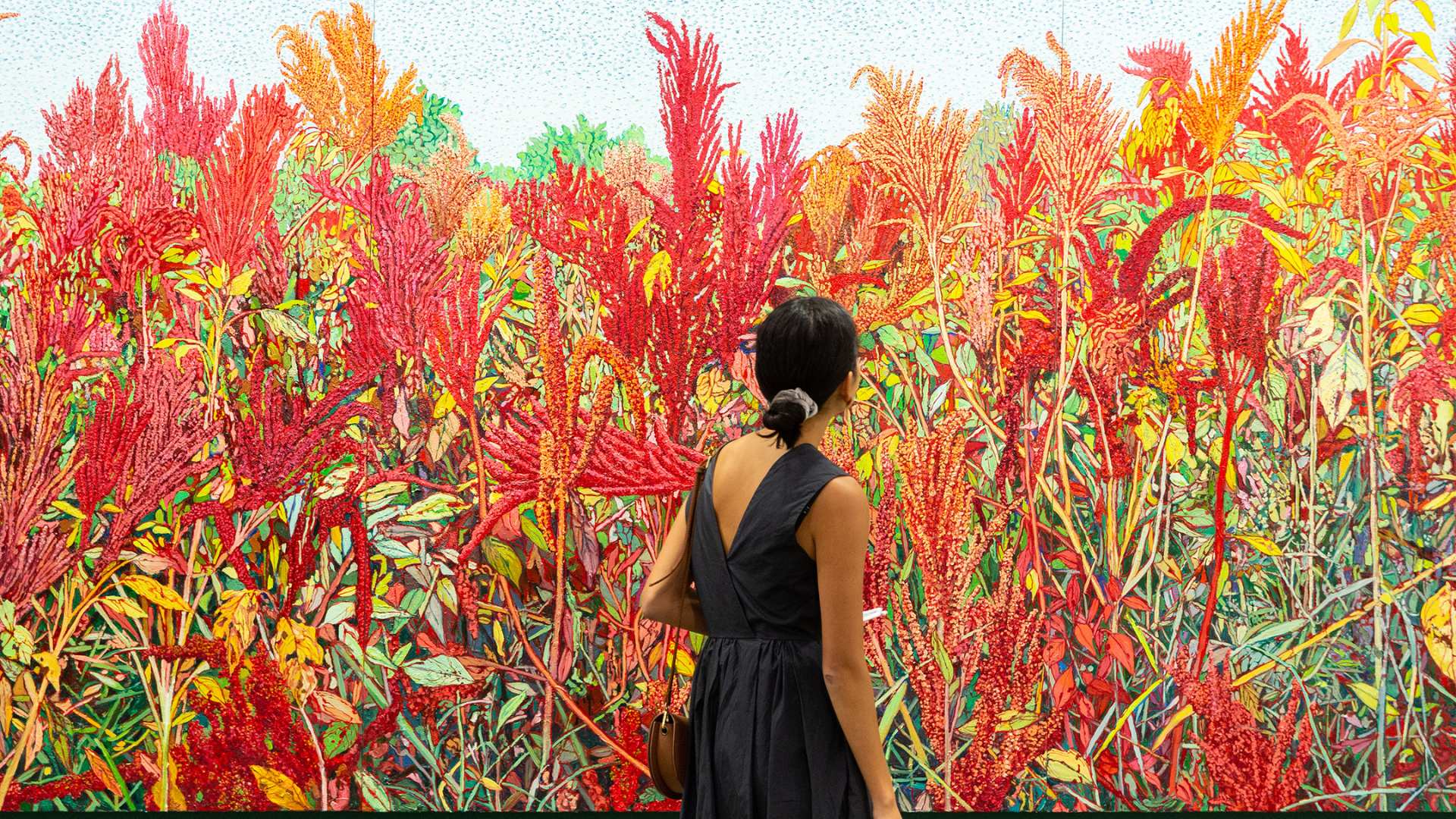

Investing in Chinese art presents a unique opportunity to diversify portfolios and engage with one of the world’s richest and most enduring cultures. Yet, it comes with its set of challenges. This article discusses these challenges and provides strategic steps investors can take to successfully navigate the Chinese art market.

The Challenges of Investing in Chinese Art

Investing in Chinese art poses specific challenges, which include limited access for non-Chinese buyers, difficulty accessing artworks within China, language barriers, issues of provenance, risks of forgery, identifying artists with international appeal, and technology barriers.

Limited Access for Non-Chinese Buyers

For those outside China, acquiring high-quality, premium Chinese art can be daunting due to language and cultural barriers and a lack of transparency in pricing and availability.

Difficulty Accessing Artworks Within China

The Chinese art market can be highly exclusive and fragmented, with collectors and galleries operating within their networks. This exclusivity can pose challenges even for those who are part of the Chinese art world.

Language Barrier

Communication and negotiation may be challenging due to the limited English proficiency among many Chinese artists and galleries.

Provenance

Limited transparency in the Chinese art market can make verifying the authenticity and provenance of artworks difficult, leading to concerns about legitimacy.

Forgery

The high incidence of forgery in China further compounds the issue of provenance. The skillful replicas can make it challenging to distinguish authentic artworks.

Identifying Artists with International Appeal

Not all talented Chinese artists have gained international recognition. This lack of international appeal may pose a challenge in identifying artists and artworks that may appreciate over time.

Technology Barriers

China’s “Great Firewall” and other technological barriers can make it challenging to access Chinese art websites and platforms. Additionally, differences in fintech infrastructure can create hurdles to completing transactions.

Overcoming the Challenges

While these challenges can seem daunting, they are surmountable. Below are key steps investors can take to navigate the Chinese art market successfully.

Engage a Trusted Art Advisor

A knowledgeable art advisor, well-versed in the intricacies of the Chinese art market, can provide invaluable assistance. They can help overcome language barriers, gain access to exclusive networks, and provide guidance on pricing, artist reputation, and market trends.

Understanding Chinese Culture and the Art Market

Acquiring a fundamental understanding of Chinese culture and art history can aid in understanding the significance and value of artworks. Additionally, staying abreast of the trends and changes in the Chinese art market can provide invaluable insights.

Leveraging Technology

Despite the existing technology barriers, investors can use VPNs and other tools to bypass restrictions and access Chinese art platforms. Employing familiar payment gateways that operate in China can ease transaction processes.

Building Relationships

Building relationships with Chinese artists, galleries, and collectors can help gain access to premium artworks and private networks. These relationships can also aid in understanding market trends and identifying promising artists.

Performing Thorough Due Diligence

A thorough investigation into the provenance and legitimacy of artworks can help mitigate the risk of acquiring forgeries. Engaging experts for authenticity checks can ensure that the artwork is genuine.

Focusing on Internationally Recognised Artists

Investing in Chinese artists who have already gained international recognition can help mitigate risk. These artists’ works are more likely to appreciate and can be easier to resell in the global art market.

In conclusion, despite the challenges, the Chinese art market holds immense potential for savvy investors. With a careful, strategic approach, and expert assistance from a reputable art advisory, investors can successfully navigate the challenges and unlock the opportunities of the Chinese art market.