The world in 2020 has seen devastating natural disasters, virus spreading worldwide, civil unrest and geopolitical conflict between countries.

In times of turmoil and economic uncertainty, how does art fare as an investment?

According to the Founder and managing director of ArtTactic, Anders Petterson, it is the younger artists and styles that are set to provide a significant influence on the market in 2020. “Younger artists will continue to inject energy into the lower end of the auction market. Meanwhile, the rise of street artists such as KAWS, Banksy, Alec Monopoly could be a sign of a bigger structural shift. With more than $87m in auction sales in 2019 (up 216% from 2018), KAWS is one of the few who have challenged existing conventions and norms.”

KAWS is a popular American graffiti artist and designer known for his toys, paintings, and prints. Pop Art and culture permeate his cartoonish Companion series of figurines, which bear a resemblance to the works of Takashi Murakami. KAWS is by no means alone in the world of pop artists. Other well-known examples include Andy Warhol, Robert Indiana and Roy Lichtenstein.

Besides heavily emphasising on consumerist culture and art for the masses, “where” and “how” art is created will also be a strong topic of discussion.

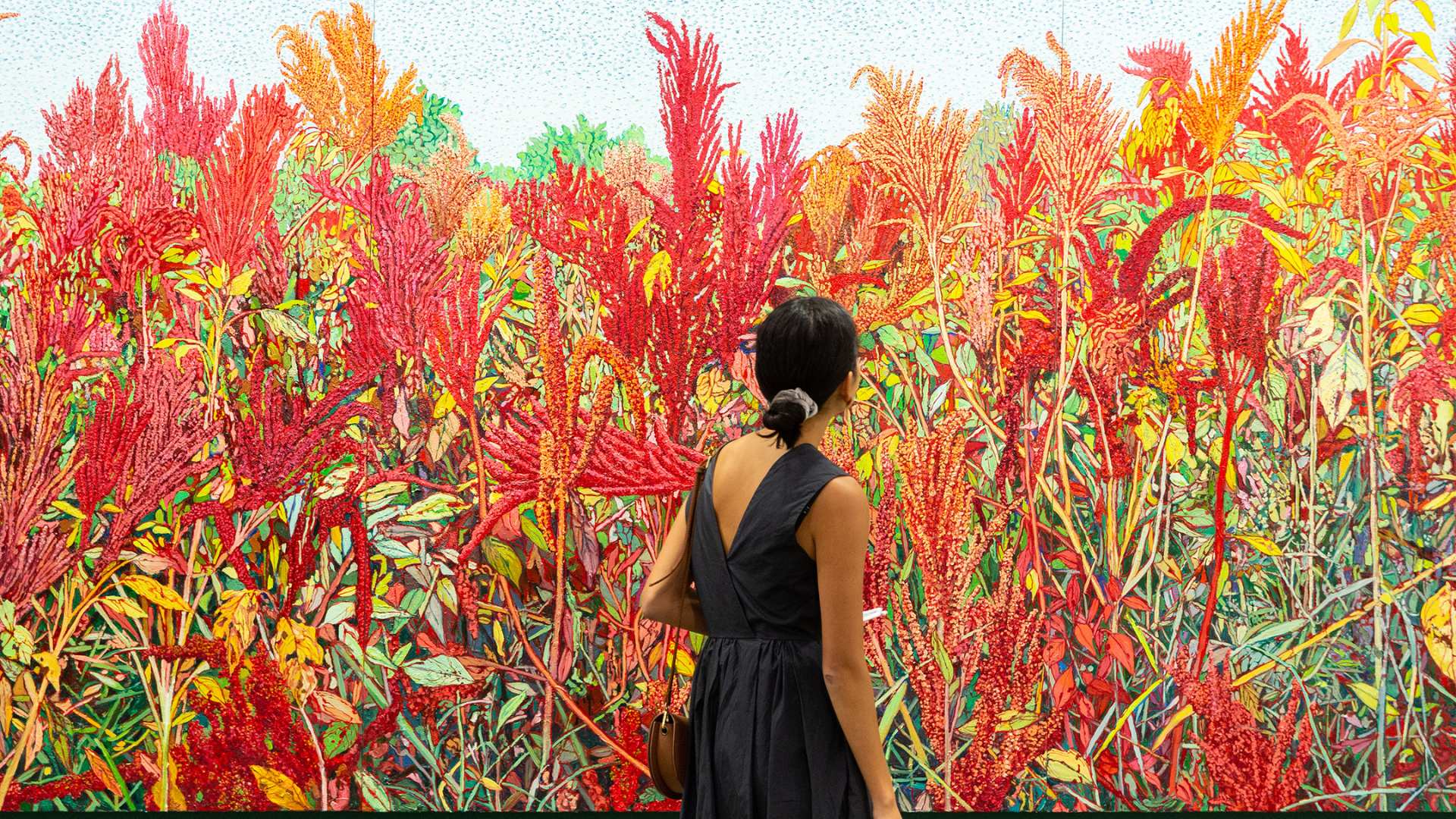

Art is becoming more decentralised. Demand for art is switching from physical galleries in major cities such as New York, Paris, Beijing and Seoul to going online, where the option to select and art is always conveniently available.

Town-goers who used to vie for the thrill of the chase have evolved to today’s art collectors. “Rich collectors don’t live for the hunt anymore. They hire art advisers who vet what’s for sale”.

Sometimes, big spenders will visit a dealer to look at an art piece their advisors recommend, with their private car’s engine running and their advisors proclaiming, “We have only 15 minutes.”

Small to medium brick-and-mortar galleries that once thrived are fast becoming extinct. Fine art that was once meant for the upper-middle class is now offered to the everyday person. Even your typical fine art buyer – with 3-piece suit and attitude to boot – is being replaced by new money, twenty-something entrepreneurs with a love for fast things.

What should we expect from the art world in 2020?

With everchanging trends, emerging markets, new consumers and fresh methods, art is set for an amazing ride in 2020. Socio-economic, environmental, and political action through fine art will be no surprise to us all. What we ought to look forward is the latest in AI technology, augmented reality and computer-generated design that may front new grounds in art.

Art as an investment in these uncertain and volatile times can serve as an option to weather the storm, not only as an asset class that is often independent to other economic factors, but as an investment that is growing in size and importance in many emerging markets around the world.

Pick the very best art investment opportunities in the region by speaking with our team at Art Works today. Find out how you can take your art collection from a casual pastime to a unique investment worth growing.