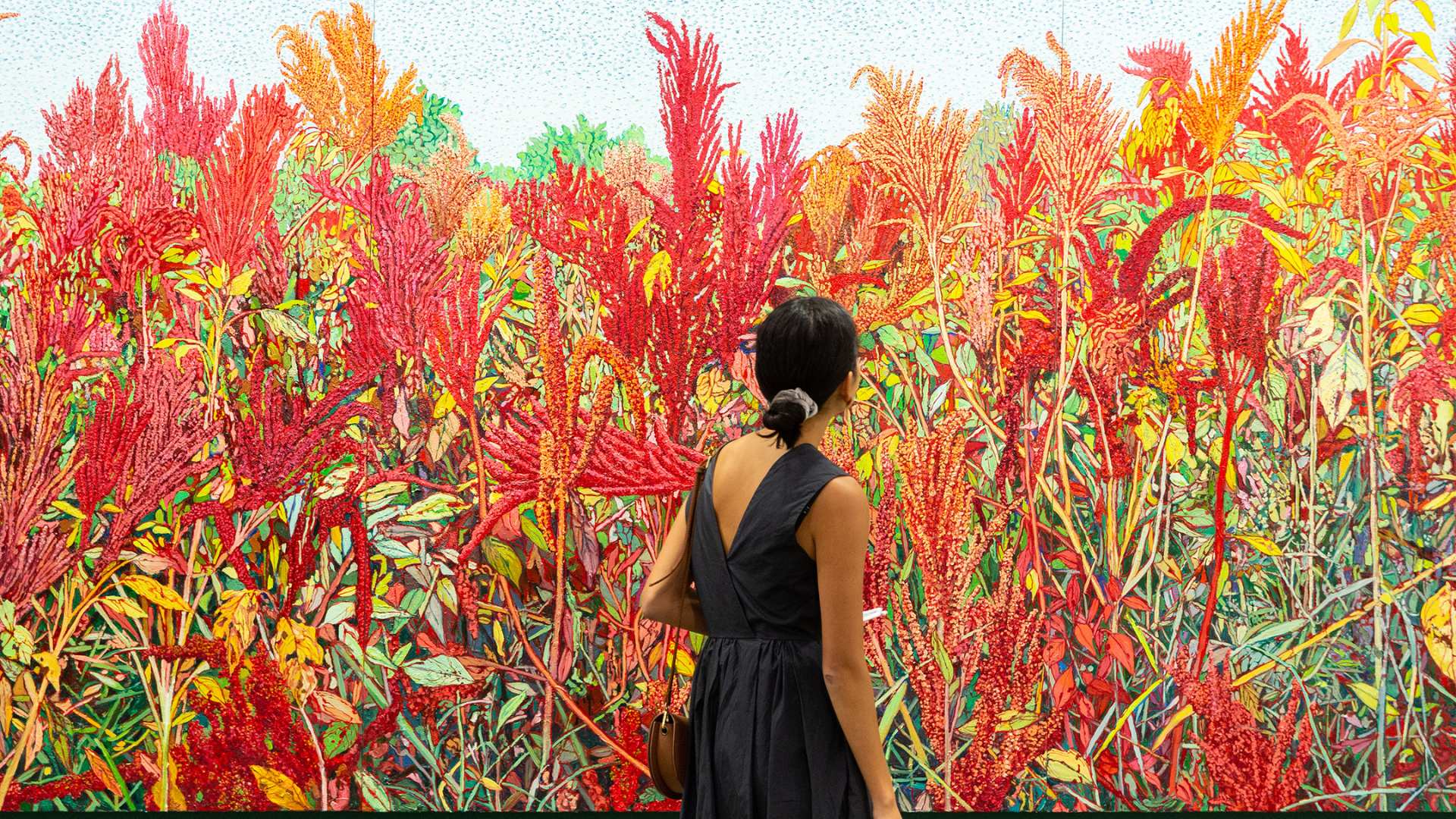

Investing in art has, in recent years, become a mainstream investment vehicle for many investors around the globe to diversify their portfolios, have something beautiful adoring their walls, while making a profit along the way.

Last year, according to the 2019 Art Basel UBS Art Market report, the art market topped $US67 billion. However, it must be noted, that investing in art is not something that can be done without a proper strategy in place. Overall value was up year on year in 2018, but over the past decade, the net gain over 10 years is 8.7 per cent – barely keeping up with inflation in many countries such as Australia!

With over 40 million items sold at auction in 2018, a prudent investment strategy in the choice of works, the time of investment, the artists and the regions from which they are produced is paramount to ensure the success of your investment in fine art.

One can look at over 40 million transactions and feel comfort in the liquidity of the market, that people can buy, sell and trade assets easily as they can with shares, bonds or utilising other financial instruments.

When investing in fine art, there are always intermediaries, galleries, and buyers’ agents – all of which are not providing their service for free, meaning this element needs to be factored into any potential capital gains you asset is set to make.

As with any investment into any security, fund or alternative investment the competency of the account manager/buyer/seller agent is paramount to your success in the market.

How should I start to invest in fine art?

Firstly, like any investment you should never invest more than you can afford to lose, as such, you need to embark on your investment with a level head and not get carried away with the emotion that often a piece of artwork can elicit.

Next, it is time to speak with a reputable buyer’s agent, not just a gallery, but also someone who understands art as an investment. These experts take the time to analyse your personal financial goals, not how many pieces of art they can sell to you.

It is important to remember on that point that there is little transparency in the fine arts market. Unlike other asset classes, the art market for the most part is unregulated. The trade in fine art is unpredictable because it depends not just on supply and demand but also on the unmeasurable factor of taste.

With your budget and buyer in place, it is time to start looking at works that fit within your budget and investment strategy – no different to any other investment strategy. Looking at fine artworks from emerging artists around Asia, in which the massive demand from China and its growing economy has created a vacuum for many fine works and as the rules of supply and demand would have it, has seen exponential rises in the price of some art pieces.

The key to investing in fine art is knowing your budget, understanding your personal investment goals and having a buyer’s agent that understands both these key points, as well as the industry, artists and the potential for capital growth of your assets and your portfolio.