Embrace the opportunity for 6% returns.

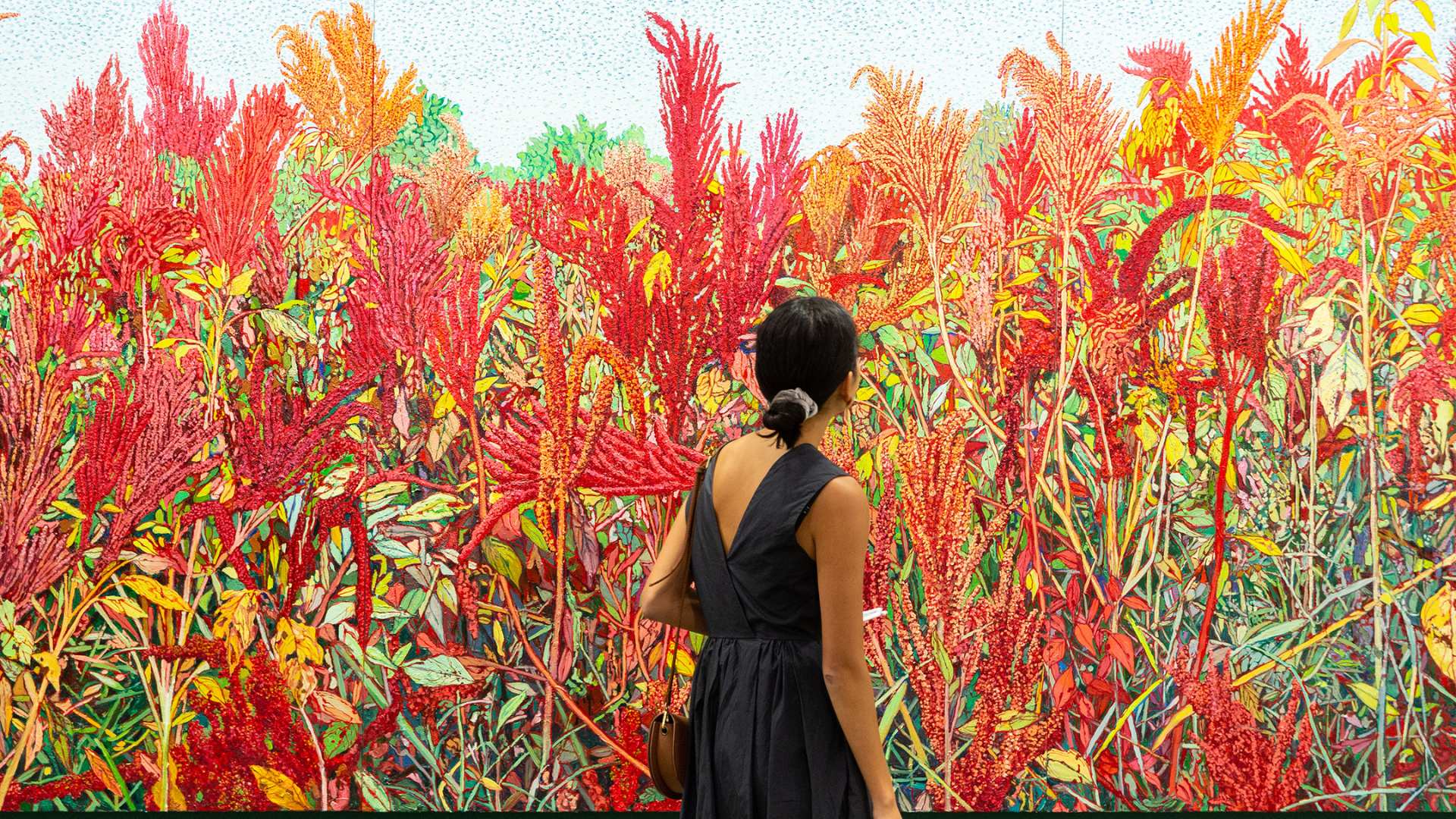

For centuries art has been something that people have marvelled at, visited in galleries, but only viewed in the great homes around the world or a 5-star hotel lobby – typically fine art was something out of reach for many.

Investment classes such as gold, property, commodities, securities – and in today’s digital world – cryptocurrency – have offered significant returns. All examples except for gold have seen massive fluctuations, the most recent has been Cryptocurrency, namely Bitcoin, with the price sitting somewhere over US$19,000 and only one-month later dropping to an eye-watering price below US$10,000.

Nothing cataclysmic occurred to Bitcoin, the currency simply crashed as people panicked to get rid of their currency. The Global Financial Crisis, led by the ‘sub-prime’ market in the US and the hyper-inflated confidence sent shockwaves around the world, putting millions of people out of jobs, their homes and their life savings.

With all the turmoil around supposedly some of the ‘safest’ asset classes around, we didn’t hear of the demise of the price of Da Vinci’s fine works of art? Quite the opposite in fact with one of his paintings selling for $450.3 million in 2017, it is safe to say the art market is alive and well.

Fine art as an investment class saw the global art market grow about 12 percent in 2017, with about $63.7 billion in sales. This outlines a resilience in the category as an investment, through its increase in asset value, despite many other classes struggling, some even ‘tanking’ over the same period.

The secret of a ‘great portfolio’ as any money manager will tell you, is diversification. Through fine art, this is not only a real option but also an entirely plausible reality. While currencies, property, and securities bounce all over the place, art not only offers great returns in terms of the asset valuation and its increase, but in the returns from leasing your art to private, corporate and public business and individuals for monthly rental return!

When it comes to desirable fine art, there are pieces available at surprisingly low prices than many would imagine, not to mention the growing returns. Take an investment in a $20,000 piece of fine art from an up and coming artist. Not only could this enjoy significant returns of 5%, 10%, 20% even 50% on your investment, but you could enjoy 6% return or $1,200 per year in rental returns!

This unique opportunity provides investors income on two fronts, as well as ownership of something truly special – a piece of fine artwork. Whether you chose to keep your artwork or liquidate for capital gain, it is important that investors understand the true earning potential of fine art, especially in Asia, where the Chinese, in particular, have an ever-increasing demand for fine art.

If you’re looking to explore fine art as an investment speaking to experts at Art Works Singapore. Our fine art experts specialise in not only sourcing the finest art for clients but also find art that is in demand in terms of leasing, creating a highly valuable and returning asset.