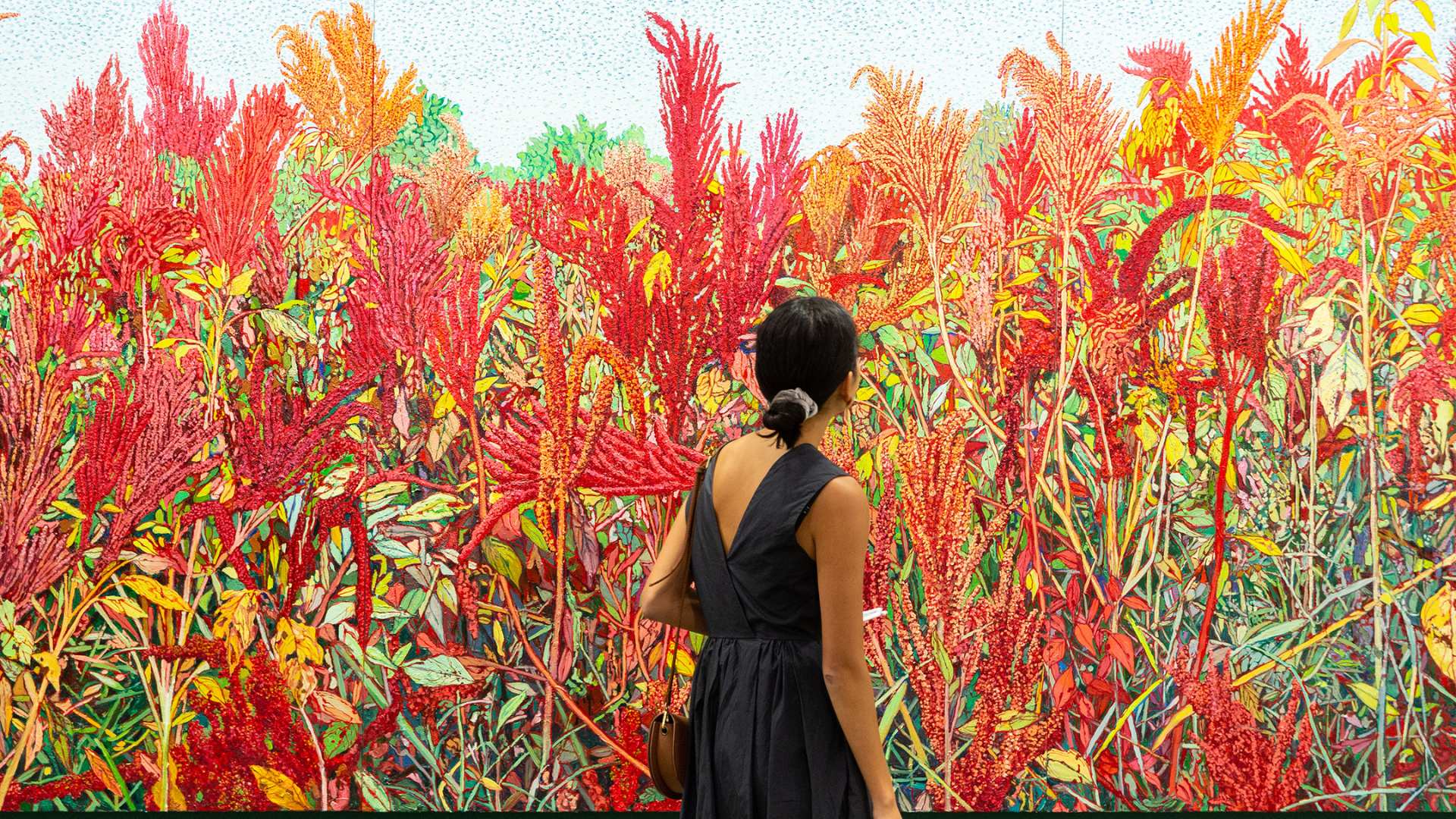

Art is a sanctuary for many people, a place away from the hustle and bustle of everyday life. It removes us from the technology and allows us to immerse ourselves in the beauty of something that taps into a range of emotions.

Re-centralisation of masterpieces into private art collections

With the rise of art collections in ‘non-gallery’ locations and non-traditional collectors – such as the rising Chinese market – there is a risk that artwork could be removed from the view of the public, or worse, destroyed through isolated occurrences of fire, vandalism or similar.

With the sale of masterpieces moving to private collectors and away from the national galleries of the world, creates the decreases the security, fireproof protection & ‘accident’ proofing that usually comes with the showcasing of a piece of art which is showcased to the public. This could lead to the loss or theft of these pieces indefinably as they are either destroyed or stolen.

Allegations of money laundering in the art world

For many years, art has been used as a form of money laundering for the ‘less desirable elements’ within the global community.

This criminal act effectively washes literally millions, potentially billions of dollars back into the legitimate system through cash payments of artworks around the globe. Although things have most certainly ‘cleaned up’ in this rather precarious area, it is still a consideration that has been plaguing the industry for literally hundreds of years.

Risk of buying fakes or stolen works

The risk of buying fakes or stolen works of art has increased as China opens its gates to the western world. Renowned for its industrial scale of counterfeiting and production, not to mention the extremely skilled artists in abundance, this could have implicated in the global art market.

For centuries across Europe, counterfeiting masterpieces have been a lucrative business, however, thanks to technology – such as carbon dating & expert computerised analysis – this is somewhat being phased out of the industry.

To avoid the risks of investing in art, buyers and investors should engage the services of art experts. Investing in art is not only investing in something beautiful but something that could potentially become extremely valuable.

Not only could a professional assist you in ensuring the art is genuine, and you get the best price possible, but that your investment sees returns almost instantly!

Art Works Singapore is one of the premiere art investment firms in Asia, helping hundreds of clients not only invest in art but realise annual returns of 6% each and every year, through leasing the art to businesses and private clients for fixed-term periods. While many may talk of returns, rather than speculating on the price of your art rising or falling, why not see returns straight away through art leasing?

Hedge your investment portfolio that not only looks great but has great return potential – you can’t put your equity portfolio on the wall! Contact Art Works today and start investing differently.