When it comes to the diversification of investment portfolios, nothing stands the test of time greater than Fine Art. With the ever-increasing market volatility, offering limited ranges of ‘heading options’, security is king when it comes to diversification.

While many assets are fluctuating or pegged to the performance of a particular exchange or executive board, art is immune to most of the factors that plague the global markets, unlike currencies, shares and even gold.

When it comes to fine art, the proof is in the results, not through the solid passive income returns that are available, but from the asset price appreciation as well.

From the recent $450 million sale of a Da Vinci that was purchased 60 years ago for forty-five thousand pounds, through to the 6% PA returns you can receive on as little as $20,000 invested in art as rental income, there are many great features to diversification through art.

When looking to invest ‘smarter’, as investors we are constantly looking to remove the emotion out of our portfolio – whether it be property, shares, currency or other asset classes. It’s fair to say, being too attached to an investment can result in less than favourable results to your overall wealth.

Here are a few tips for investing smartly in art:

Remove the emotion

You’re not only purchasing the art piece due to the love of art but for its potential financial return. Often stories of unsuccessful investments in art are typically due to advice on the investment not being objective but being given through advisors that look at the art, rather than the bottom line.

Looking at art through an objective lens

You’re searching for an asset class that diversifies your portfolio but also provides passive annual income as well as something that brings joy. While we all wish there was a way to bulletproof our investments, being objective is the key.

Look for art as a passive income

When it comes to that passive annual income, how would 6% PA on your investment for a minimum two years sound? Many savvy investors purchase art and rent it out to corporates individuals or expats looking to add some ‘class’ to their home, office or boardrooms. By using art as a passive income, you can receive the rental income as well as the asset value appreciation.

If you think art could be the answer to diversification and bulletproofing your portfolio speak to ArtWorks today for objective art investment advice and art rental options.

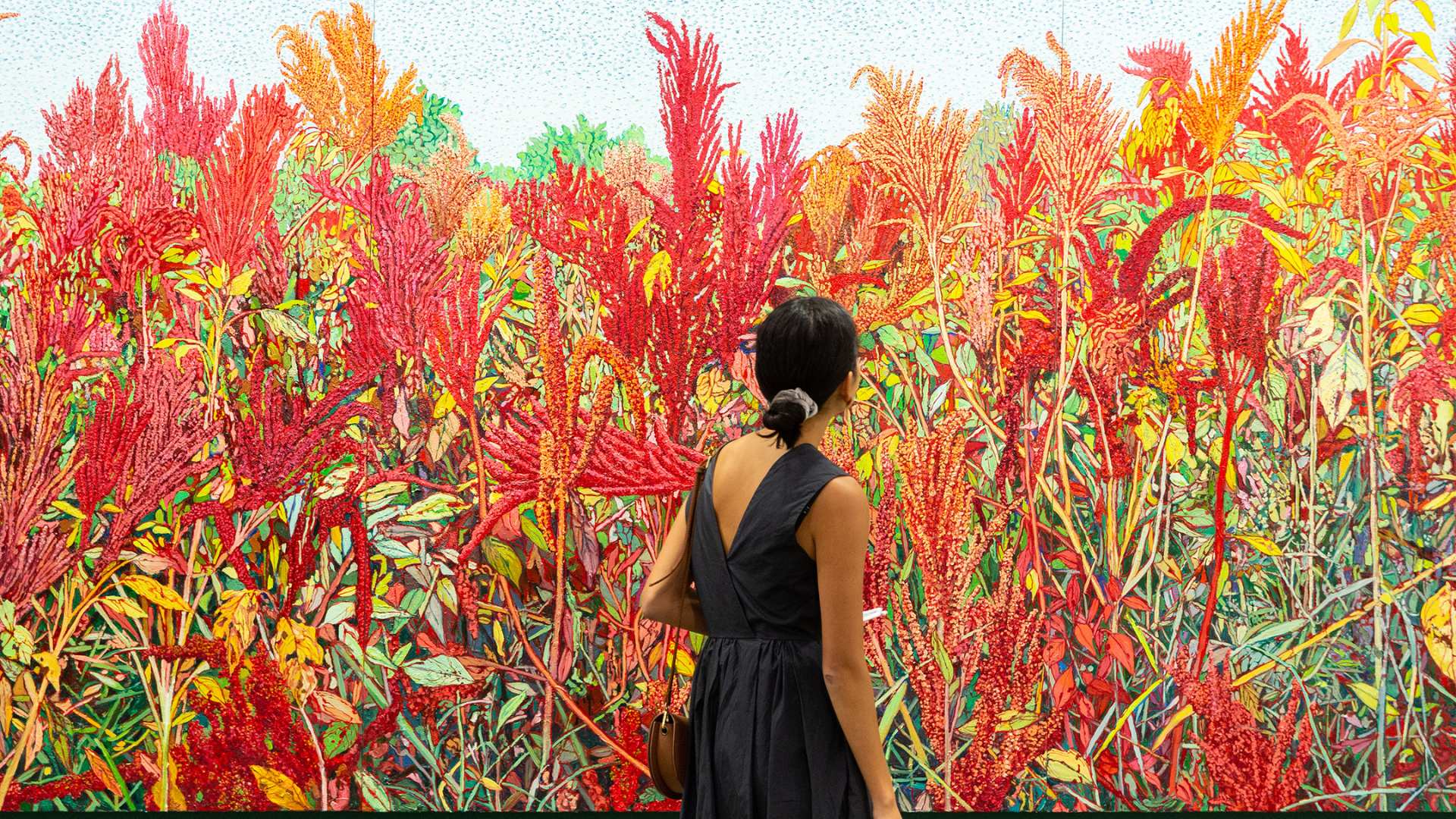

As industry experts in art and art investment, our team can provide turnkey investment solutions to meet your investing needs. Be a part of the many savvy investors throughout Singapore and South East Asia who are focusing on art investment as a tool for diversification.

Call the team art ArtWorks today for a walk around our gallery and a prospectus on how fine art investment and leasing could improve your portfolio’s prospects.