Introduction

In today’s complex financial ecosystem, diversification is more than a buzzword—it’s a necessity. As traditional investment avenues such as stocks and bonds increasingly exhibit signs of volatility, wealth managers, investment advisors, and high-net-worth individuals are expanding their horizons. While options like real estate, commodities, and cryptocurrencies have entered the alternative investment sphere, fine art emerges as a compelling category, offering both cultural enrichment and financial resilience.

The Evolving Landscape of Alternative Assets

The role of alternative assets in wealth management is undergoing a significant transformation. According to JP Morgan Private Bank, their clients are allocating between 15% and 30% to alternatives, with figures exceeding 50% for those with multi-generational wealth objectives. This trend, supported by the Deloitte Private and ArtTactic Art & Finance report, signifies a fundamental shift in investment strategy. The report accentuates that a resounding 85% of wealth managers support including art in balanced portfolios as a promising alternative asset class.

Robustness in Numbers

Numbers often reveal the hidden strengths of investment options, and in the case of fine art, they tell a compelling story. According to The Art Basel and UBS Global Art Market Report 2023 global art market had a valuation exceeding US$67.8 billion in 2022. During times of economic disturbances, it displayed remarkable resilience, outperforming traditional investment options like the S&P 500.

The Knight Frank Luxury Investment Index further illuminates this point. While traditional asset classes like real estate and equities have experienced a tepid performance, art showcased an impressive 12-month growth rate of up to 30%.

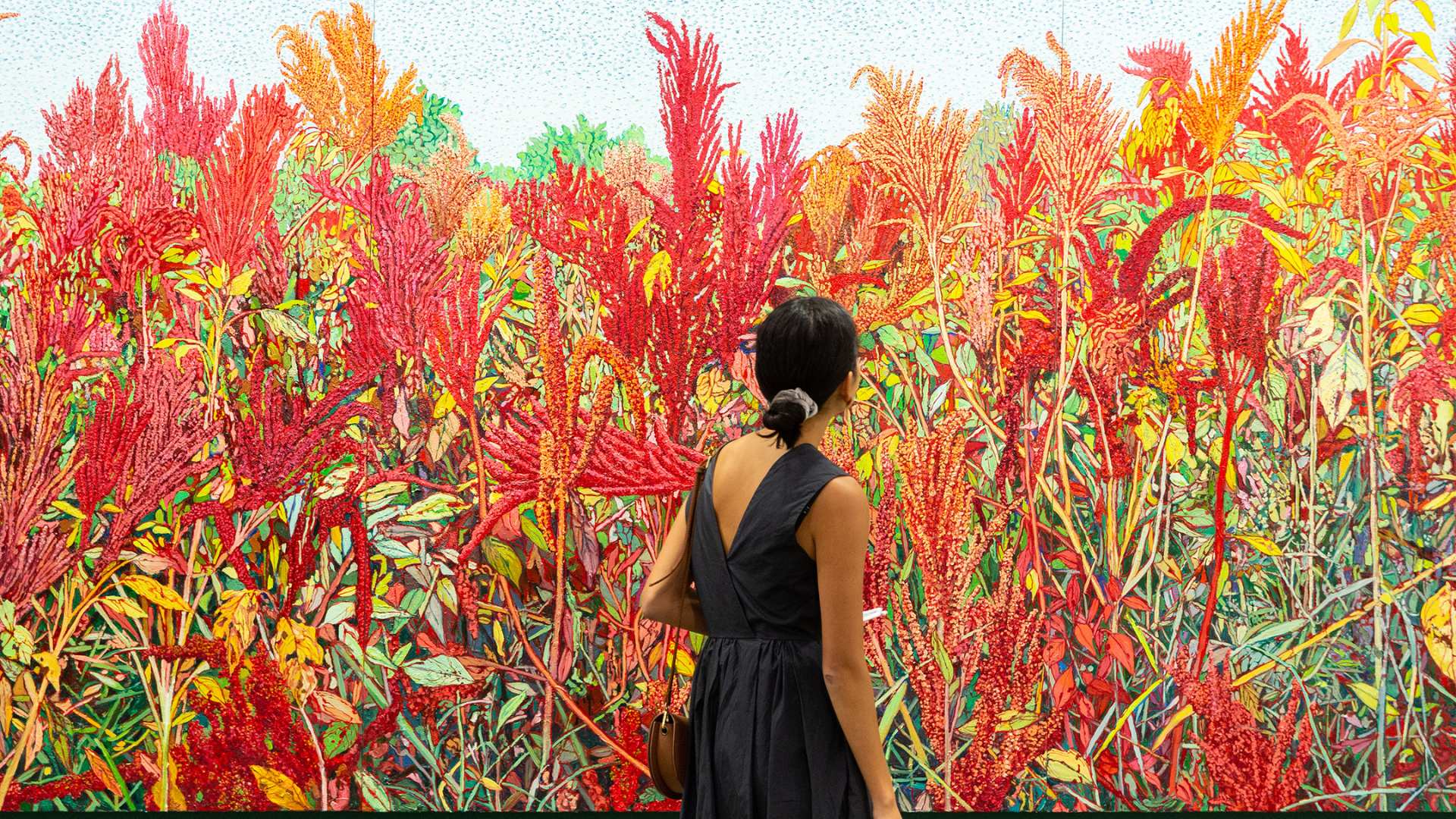

A Global Perspective: The Rise of Southeast Asia

As globalization continues to knit the world closer, investment opportunities are increasingly becoming borderless. The burgeoning art market in Southeast Asia, particularly in Singapore, is a testament to this phenomenon. With a market exceeding $1.3 billion, Southeast Asia is not just a regional player but a global contender in the art investment scene. This growth is not merely a regional development; it’s a global shift that is diversifying investment portfolios and opening new doors for capital appreciation across the world.

Redefining Access to High-Value Assets

One of the remarkable trends in the art market is its democratization. Companies like Art Works Advisory are pioneering this change by leveraging their expertise in art, finance, and technology to make high-value artworks accessible. They are not merely selling pieces of art; they are offering investment opportunities characterized by long-term financial growth. This innovation is broadening the art market to include not just traditional collectors but also a new wave of investors eager to diversify their portfolios.

The Future of Art and Alternative Investments

Art investment should not be viewed in isolation but as an integral part of a broader investment strategy. The market has its own unique variables, including rapidly evolving consumer preferences and technological innovations that are revolutionizing how art is bought, sold, and appreciated. Yet, despite these variables, the underlying metrics remain strong, and the market fundamentals are consistent with long-term capital appreciation. As we move forward, technological platforms are likely to play an even more significant role, offering fractional ownership options and thereby further democratizing access to this lucrative asset class.

Conclusion

As the world of alternative assets continues to evolve, fine art stands out as an exceptional investment option. It offers not just a visual and emotional appeal but also holds tangible and enduring financial merits. In a diversified investment strategy, fine art serves as a multi-faceted asset that enriches both the soul and the portfolio. As we navigate through the complex terrains of modern finance, the role of art is becoming increasingly significant—not merely as a cultural artifact but as a robust and reliable asset class in the age of alternative investments.