On an average Thursday afternoon, approximately 80,000 art enthusiasts, collectors and investors flooded the Swiss town of Messe Basel, transforming the unassuming town and its surrounding areas into a playground of million-dollar paintings, towering public sculptures and sprawling art installations. The reason? Only the biggest art fair in the world.

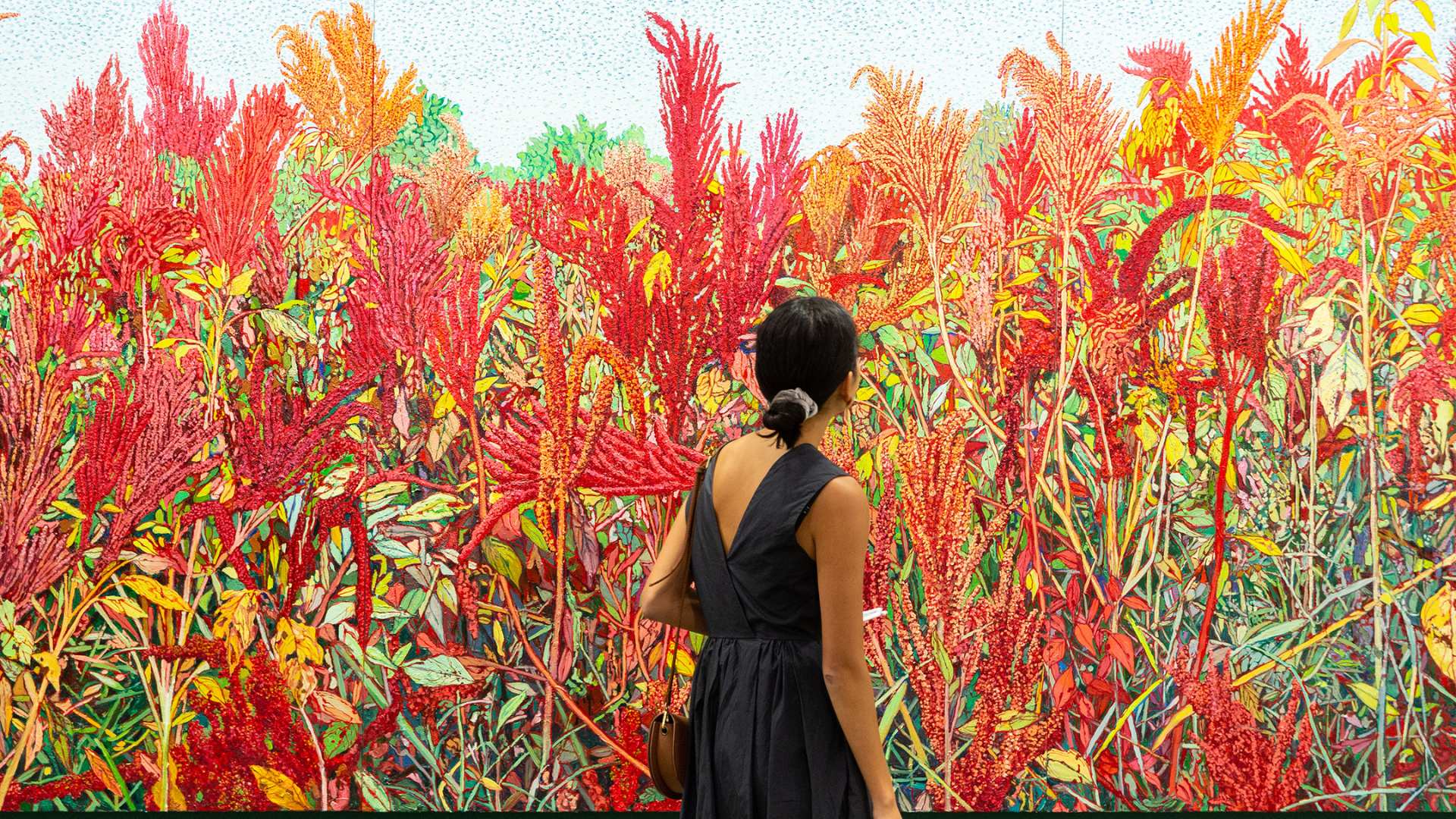

Founded in 1970, Art Basel is a five-day fine art extravaganza honouring the lasting power of Modern and Contemporary art. This year, the event showcased more than 200 galleries and around 4000 artists — which makes it among the biggest of any international art fair this year. Other than the core fair itself, Art Basel also organised various spinoff ‘Parallel Fairs’ and alternative programmes which drew attention to certain exciting subsets of the fine art world. In particular, the Liste Art Fair Basel stood out as a haven for relatively new contemporary artists, while the Art Basel Unlimited highlighted large-scale sculptures, paintings, video, installations and live performances which embraced the unconventional and the avant-garde.

The outlook at Art Basel 2023 seemed highly positive with a number of impressive sales made over the span of five days. The Art Newspaper reported that by the second day, sales were estimated to be about $245 million, with six of the top galleries making up 70% of this amount. Among the sellers, Hauser & Wirth was the strongest, reporting about $57 million in sales and selling more than 45 works over the first two days according to Artsy. The world-renowned gallery also sold the most expensive work of the fair: an imposing Louise Bourgeois spider worth $22.5 million. Pace Gallery, White Cube, David Zwirner, Almine Rech, Thaddeus Ropac, Xavier Hufkens, David Kordansky Gallery and Di Donna were among the players that made multiple million-dollar deals, indicating that the art market remained active and profitable despite uncertain tides in the global economy.

Observers also noted that Asian buyers provided a noticeable influence at Art Basel, contributing a significant proportion to the overall sales. David Zwirner, founder of the gallery by the same name, told the New York Times that “Asian collectors are here. They can travel without restrictions”. He also speculated that 20 percent of his deals on day one were to Asian clients. ArtNewspaper also noted that Asian clients had a strong presence at the fair, with relatively fewer American buyers. Certainly, the Asian market is indeed on the rise, producing a growing number of high-net-worth (NNWI) and ultra-high-net-worth (UHNWI) individuals who are inclined toward art investments as a viable way to grow generational wealth.

If we were to declare a winner at Art Basel, it wouldn’t be any one gallery — it would be the modern Abstract painters who generated the biggest sales that week. Mostly American, mostly male, these painters drew the most attention and the greatest sums of money as opposed to their counterparts from the Figurative or Realist camps. Big artist names such as George Condo, Marcus Bradford, Tracey Emin and Jack Whitten pulled off multiple six figure and million-dollar sales through different brokers, suggesting a healthy appetite for their abstract canvasses. Abstract works tend to be recommended as long term viable investments due to their striking visual qualities and ability to transform any setting — be it a high street gallery, a monotonous corporate office or cozy living room. Removed from any specific cultural context, the language of abstraction is universal, which adds to their appeal for international audiences. Paintings such as Bradford’s or Emin’s don’t have to gesture to any specific subject matter, but their vivid, mesmerising colours and energetic, fluid forms speak toward a deeper emotional resonance that attracts art enthusiasts and investors alike.

Overall, Art Basel returns for another successful year, providing valuable information to spectators as to what works and what doesn’t in the current art market. Overall, buyers seem somewhat cautious in the midst of an evolving global economy, but this by no means signifies an economic decline as art investments continue to provide strong returns for art buyers looking to merge their passion for art with strategic financial planning.