While many global investors dodge and weave the insecurity of the securities market, the crashing of many domestic housing markets and the instability of the geopolitical situations around the globe, the ultra-rich will spend over $2.7 trillion on art by 2026.

This growing trend has seen artworks by the most famous artists of history been purchased at auctions for simply eye-watering prices – such as the Salvator Mundi painting by Leonardo da Vinci, for over US$400 million in 2017.

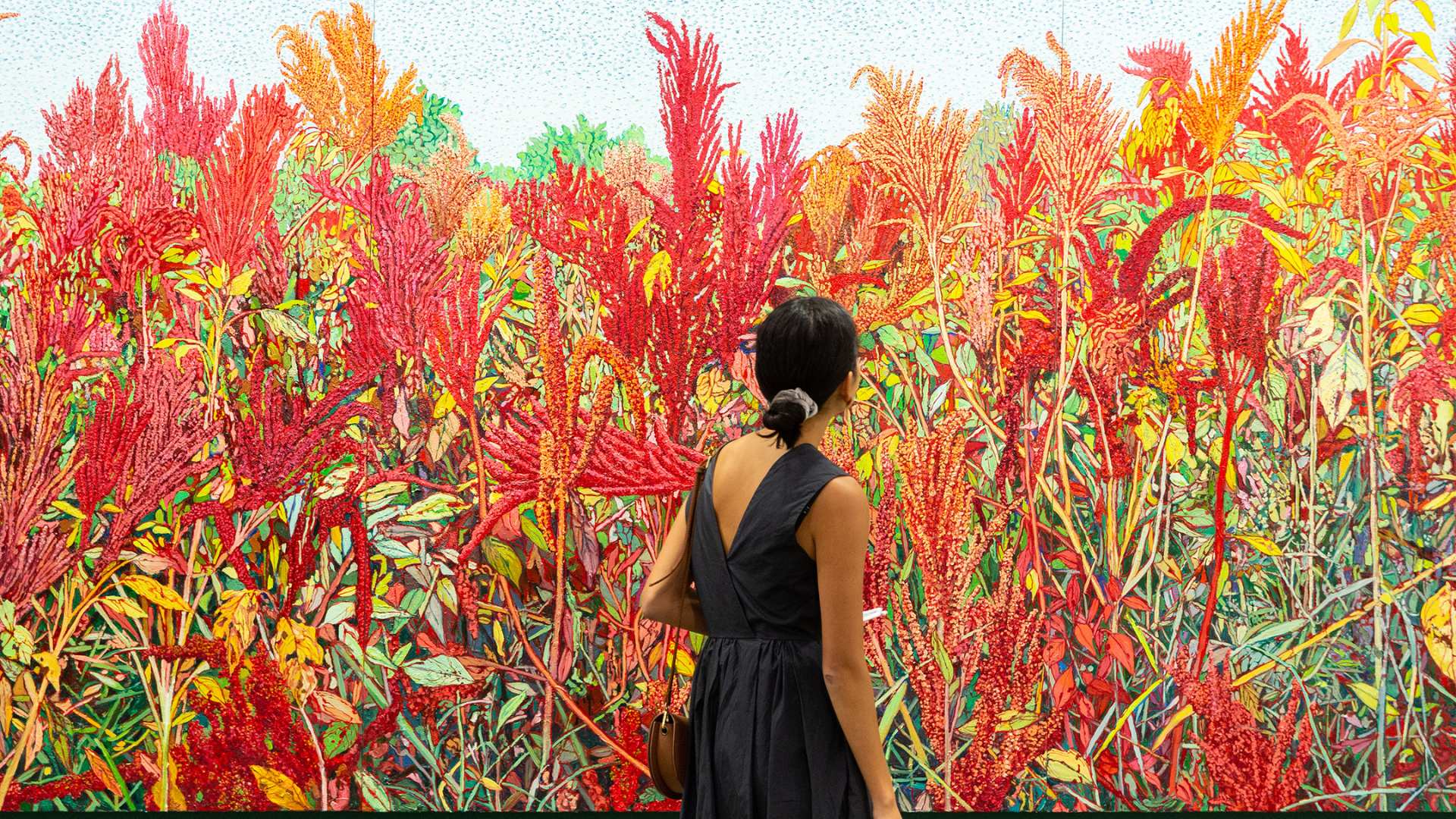

Not only is art a sign of style, wealth and power when adorning the walls or halls of homes and corporate offices around the world, but it is a solid asset class that can offer not only asset value increase, but annual returns through leasing and a range of other tax and financial incentives.

According to a Deloitte report on investment in art besides a potential increase in value, art provides additional financial benefits such as:

- Art provides a hedge against inflation and currency devaluation

- There is little risk of losing your principal if you purchase wisely

- No minimum investment is required

- Art investments enjoy favourable tax treatment

- Reduction of risk because of its low correlation with other financial assets

- Possibility of earning extra revenue by lending out the work or of participating in events, such as exhibitions and meetings of experts

- Art has no geographical risk and can be moved easily

- Art can be insured against calamity risk

Art provides so much more than an investment, it’s a hedging tool that is favourable in terms of tax, risk adverse and it looks far better on your wall than a government bond in a frame!

If you’re embarking into the art world, especially the fine art world, for the first time how can you be sure that your investment is solid? Just because it looks great, it doesn’t mean that you couldn’t fall foul to a forgery on a piece of artwork.

Just like investment in securities, property or any asset class, it is always wise when looking to invest to first speak to experts. Experts can work within your budget be it $5,000 or $500 million and takes the time to understand your investment needs, goals and desires. Art consultants can facilitate the purchase of fine art from around the world so you can create the ultimate art collection of your dreams.

It is not just the $2.7 trillion of the ultra-rich that provides the ultimate in opportunity, but the $63.7 billion annual market for art around the world that is open for everyone – like you – to capitalise, hedge, minimise risk and profit from.

To discuss with an expert art consultant about gifting, purchasing, sourcing or investing in artworks that also can realise annual returns to owners through a corporate artwork lease program, speak to the team at Art Works today and join the growing number of individuals and companies investing in art.